Provided that this sub-rule shall not apply to a company which has not declared any dividend in each of the three preceding financial year. 13 June 2022.

Preference Shares Case Facts By Hhq Law Firm In Kl Malaysia

Regulation 12 43 of LODR.

. A out of the profits of the company for that year arrived at after providing for depreciation in accordance with the provisions of sub-section 2 or out of the profits of the company for any previous financial year or years arrived at after providing for. And 2 the corporate rescue mechanisms. The entire Companies Act 2016 will come into operation except for the sections on.

A has given notice which has not been revoked to the registrar of its intention to carry on business as an investment company and. What is Dividend Declaration. 1 the company secretarys registration with the Registrar of Companies.

1 The rate of dividend declared shall not exceed the average of the rates at which dividend was declared by it in the three years immediately preceding that year. The board may declare interim dividend during any financial year or at any time during the period from closure of financial year till holding of the annual general meeting. Provisions of Companies Act 2013 relating to dividend.

1A Subject to subsection 1B any profits of a company applied towards the purchase or acquisition of its own shares in accordance with sections 76B to 76G are not payable as dividends to the shareholders of the company. Dividend shall be paid within Thirty days of declaration of Final Dividend and if such Dividend is unclaimed or unpaid then such Dividend shall be transferred to an Unpaid Dividend account within seven days after expiration. The domestic company declaring dividend will be required to withhold tax on resident payees at 10 under section 194 where dividend is paid in excess of Rs.

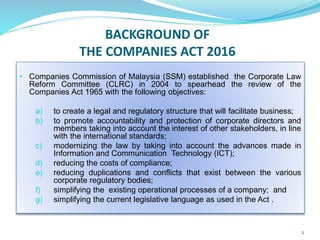

Under Section 205 of the Companies Act 2013 1 contains the regulations for the declaration and distribution of dividend. Generally a dividend declaration is an event where you announce the dividend payment to shareholders. Companies Commission of Malaysia.

Companies Act 2006. It is a share of profits of the company. 5000 to a shareholder and non-resident payees at the rate of 20 or as mentioned in the Double taxation avoidance agreement DTAA whichever is lower.

This non-distribution of dividends usually happens when the company could not show profits. A company cannot pass a resolution for the declaration of dividend without passing a resolution for the adoption of accounts. The basic principle of declaration of dividend is that it shall be paid out of profits only.

As per the provisions contained in section 127 of the Companies Act if a company declares a dividend but it does not pay the dividend within 30 days from the date of its declaration to the shareholder entitled to such payment of dividend every director of such company will be penalised with imprisonment of up to two years term and along with fine that. Separate Bank Account is required to be opened and amount of dividend payable shall be credited to the said account within 5 days of declaration. 833 Meaning of investment companyUK.

Dividend is defined under Section 2 35 of the Companies act 2013 includes any interim dividend. A Board Meeting should be called by issuing a notice and rate at which dividend is payable must be specifically stated in the resolution passed. Within five days of declaration of Dividend separate bank is required to be opened and amount of Dividend shall be credited to such Bank account.

There are certain circumstances in which the non-distribution of dividends can constitute. The following clarifies the constitution of your profits. Dividends are sum of money to be paid to the members of the company out of the profits made by the Company.

The Articles must provide power to pay Interim dividend and Board must be authorized to declare Interim dividend. Whist the Companies Act 2016 provides for the distribution of dividends by companies companies at times do not provide dividends much to the chagrin of shareholders. According to Section 403 of the Companies Act you should declare dividends only if there are profits available at the time of declaration.

Registered holder of shares or By order of registered holder to any person or To his banker. Prepare a statement of dividend in respect of each shareholder and it must be ensured that the dividend tax is paid to the tax authorities within the prescribed time. It has two principles ie 1 the dividend is to be paid out of the companys profits.

Time limit for payment of dividend The time limit for payment of dividend is thirty days from the date of its declaration of dividend. Dividends distributions and company law. Recipient of dividend Dividend is paid only to the registered shareholder of such share or to his order or to his banker.

For declaration of dividends there is no standard format or any form of solvency statement that must be signed. Hence a company shall adopt its books of accounts first and then only entitled to declare the dividend. It may be noted that dividend is paid to shareholders in proportion to the amount paid-up on.

Dividend In the CA 2016 the dividend rule is found in s131. The dividend which includes interim dividend can be paid out of the. 5 No dividend shall be paid by a company in respect of any share therein except to the registered shareholder of such share or to his order or his banker and shall not be payable.

The directors must merely. 1 No dividend is payable to the shareholders of any company except out of profits. According to law it is mandatory for every company having share capital that makes a profit to declare and distribute a dividend to its shareholders.

And 2 the dividend should not be paid if the payment will cause the company to be insolvent. 4 The amount of the dividend including the interim dividend shall be deposited in a scheduled bank in a separate account within five days from the date of declaration of such dividend. B since the date of that notice has complied with the following F9 requirement.

1 In this Part an investment company means a public company that. 1 No dividend shall be declared or paid by a company for any financial year except. The Company shall pay dividend to.

Than when a dividend may be declared. 16 April 2016 Updated.

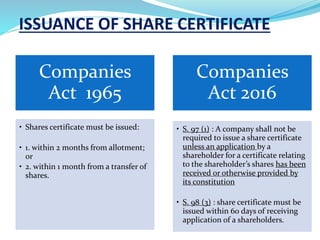

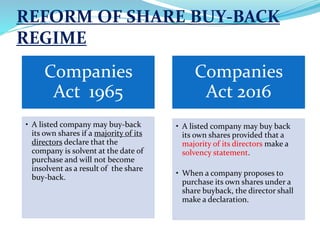

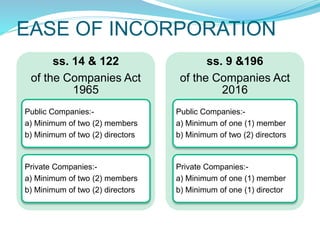

Key Changes About The New Companies Act In Malaysia Lo Partnerslo Partners

The Malaysian Companies Act 2016

The Malaysian Companies Act 2016

The Malaysian Companies Act 2016

The Malaysian Companies Act 2016

The Malaysian Companies Act 2016

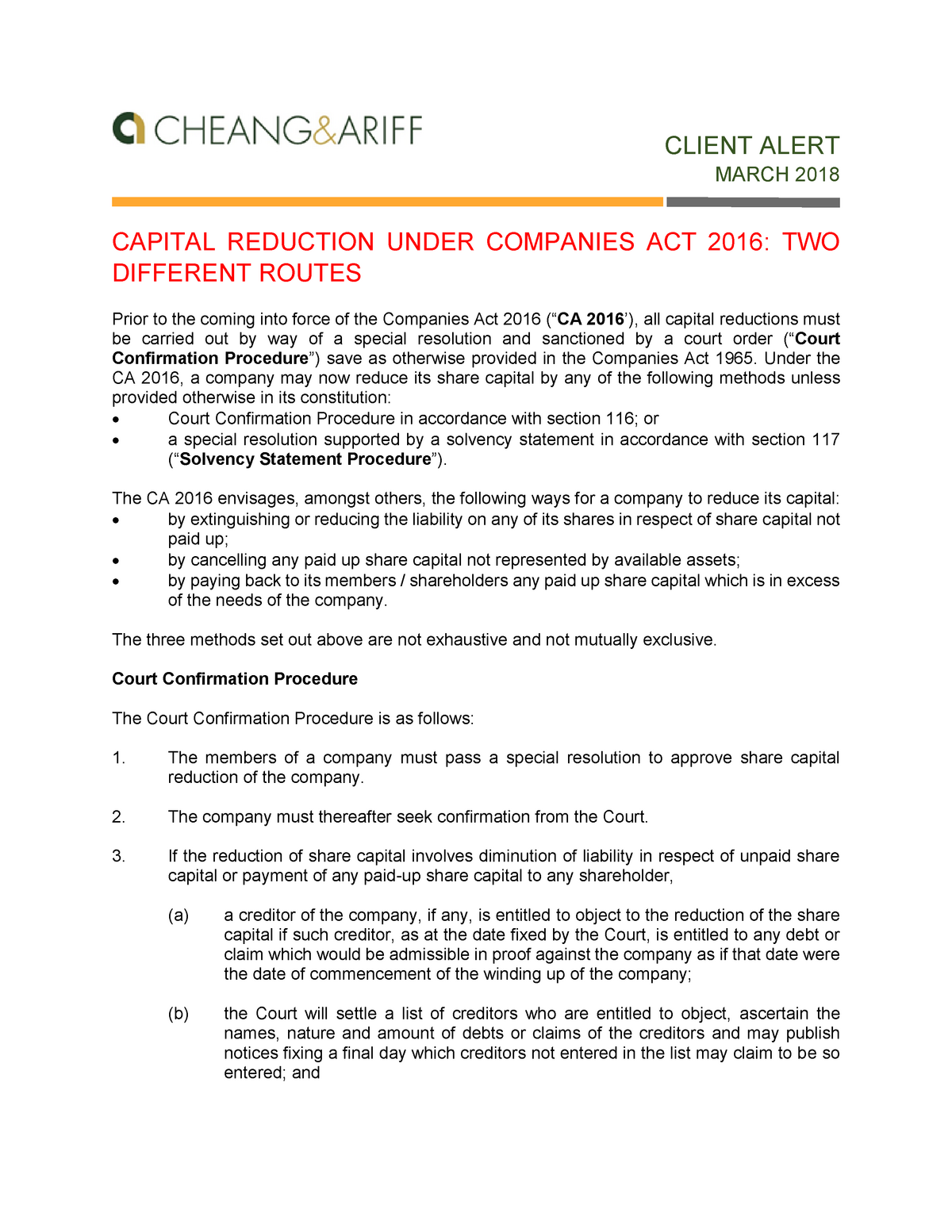

Capital Reduction Under Companies Act 2016 Client Alert March 2018 Capital Reduction Under Studocu

Companies Commission Of Malaysia Faq Voting On Preference Shares And Single Member Public Company Meetings

_bill_2016_1510037412_19196-17.jpg)

Company Bill Powerpoint Slides

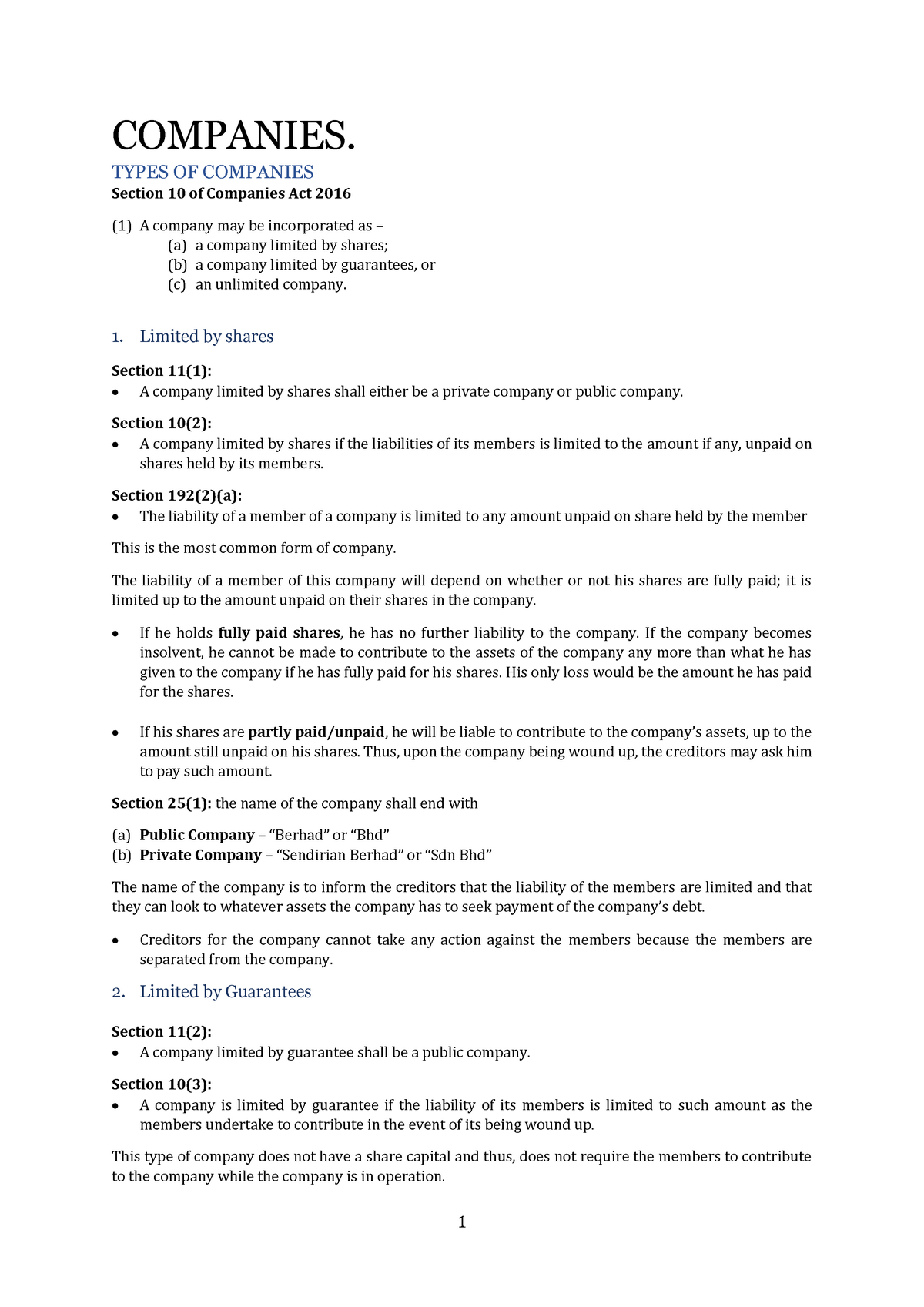

Companies Act 2016 Companies Types Of Companies Section 10 Of Companies Act 2016 1 A Company Studocu