Taxable Income MYR Tax Rate. Malaysia Personal Income Tax Rate.

There will be a two-year stamp duty exemption for the first RM300000 for houses priced up to RM500000.

. YA 2019 Resident company with paid-up capital of RM25 million and below at the beginning of the basis period SME Note 1 On first RM500000 chargeable income 17 On subsequent chargeable income 24 Resident company with paid-up capital above RM25 million at the beginning of the basis period 24 Non-resident company branch 24 Note 1. Tax rates range from 0 to 30. This would enable you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay to RM402.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. On the First 5000 Next 15000. Malaysia Residents Income Tax Tables in 2022.

First-time homebuyers will have stamp duty exemption for homes between RM300000 to. Income Tax Rates and Thresholds Annual Tax Rate. 20192020 Malaysian Tax Booklet Copy link.

Its a new year and that means new rules for calculating how much tax youll owe. This would enable you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay from RM1640 to RM585. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practice.

Want to receive regular updates. For 2022 tax year. Download PDF 20192020 Malaysian Tax Booklet.

Petroleum income tax. Calculations RM Rate TaxRM A. However since you are already paying income tax at a higher bracket every month via the monthly tax deductions MTD for salaried employees it is highly likely that you are paying more income tax than you should be.

Income Tax Rates and Thresholds Annual Tax Rate. It incorporates key proposals from the 2020 Malaysian Budget. Malaysia Residents Income Tax Tables in 2020.

Other rates are applicable to. Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020. Malaysian ringgit A non-resident individual is taxed at a flat rate of 30 on total taxable income.

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. On the First 5000. 20182019 Malaysian Tax Booklet 15 Offences Penalties Make an incorrect tax return by omitting or understating any income or incorrect information RM1000 to RM10000 and 200 of tax undercharged on conviction or 100 of tax undercharged in lieu of prosecution Wilfully and intentionally evade or assist any other person to evade tax RM1000 to RM20000 or.

This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. Malaysias 2019 Budget will see an increase in stamp duties to 4 from 3 for transfer of real properties that are RM1 million and higher. No other taxes are imposed on income from petroleum operations.

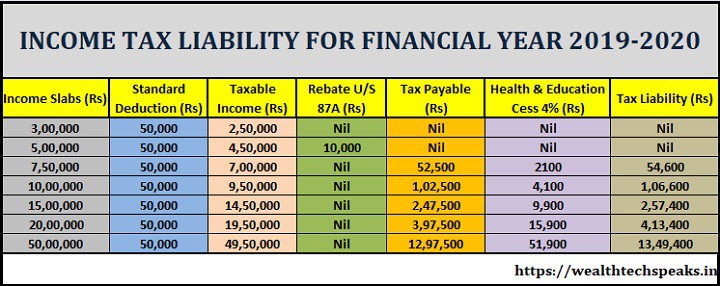

For resident taxpayers the personal income tax system in Malaysia is a progressive tax system. 2019 Tax Brackets for Single Filers Married Couples Filing Jointly and Heads of Households. Rate For Unmarried Individuals Taxable Income Over For Married Individuals Filing Joint Returns Taxable Income Over For Heads of Households Taxable Income Over.

You can calculate your taxes based on the formula above and just make sure your total income in the first column comes up to. Thats a difference of RM1055 in taxes. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020.

An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to RM34500.

Spain Number Of Job Vacancies 2022 Data 2023 Forecast 2019 Historical

Budget 2019 The Proposed Tax Changes That The Business Must Know Cheng Co Group

Malaysian Tax Issues For Expats Activpayroll

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Individual Income Tax In Malaysia For Expatriates

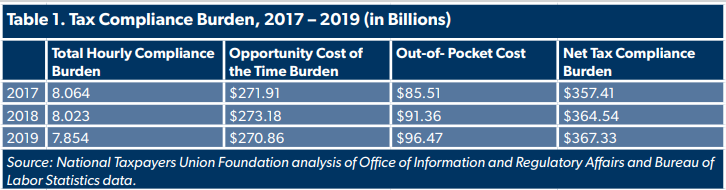

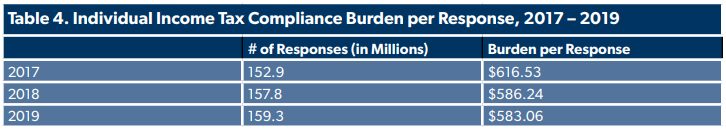

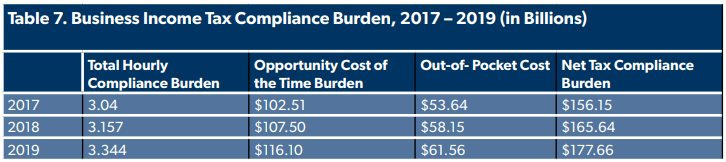

Tax Complexity 2020 Compliance Burdens Ease For Second Year Since Tax Reform Foundation National Taxpayers Union

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018

Tax Complexity 2020 Compliance Burdens Ease For Second Year Since Tax Reform Foundation National Taxpayers Union

Income Tax Malaysia 2018 Mypf My

2019 Income Tax Calculator Store 55 Off Www Ingeniovirtual Com

Tax Complexity 2020 Compliance Burdens Ease For Second Year Since Tax Reform Foundation National Taxpayers Union

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

The State Of The Nation Finding Room To Lighten The Middle Income Tax Burden The Edge Markets

The State Of The Nation Finding Room To Lighten The Middle Income Tax Burden The Edge Markets

/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)